The taxable Period of SST is. Companies operating within Malaysia will be required to register for GST with the customs department.

Step By Step Guide To Apply For Gst Registration

Goods and Services Tax in Malaysia can only be collected by GST registered entities.

. Such businesses can apply for voluntary registration. Business under GST group divisional registration Sole proprietorships Reference number for GST matters M91234567X MR2345678A. The businesses already registered with the GST dont need to register again for SSTSales and Service Tax.

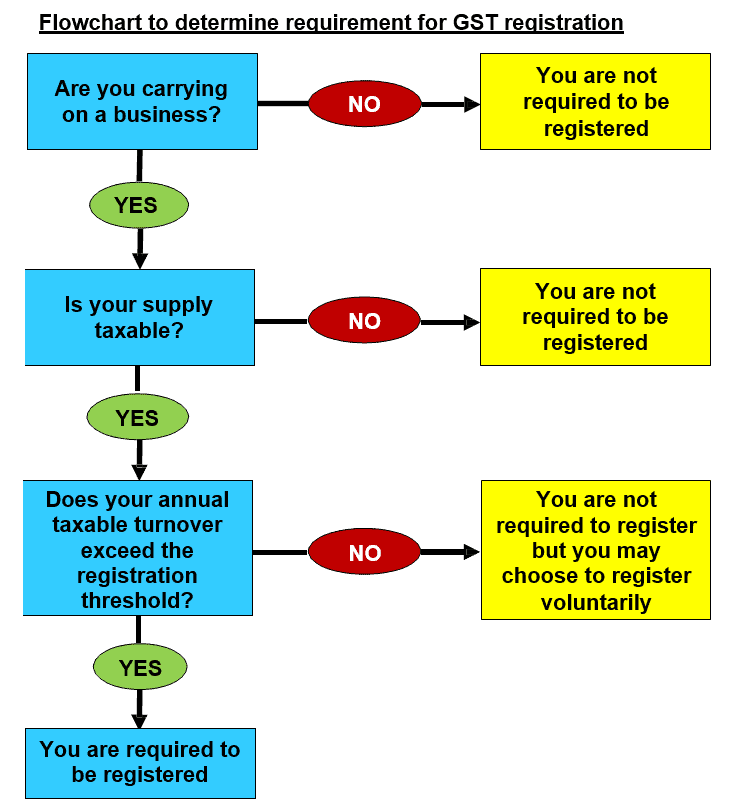

Malaysian businesses are required to register for GST when their turnover threshold hits RM500000. A business is not liable to be registered if its annual turnover of taxable supplies does not reach the prescribed threshold. The implementation of GST system that has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many booksAs a broad based tax GST is a consumption tax applied at each stage.

Limited Liability Partnerships LLP T08LL1234A. Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500000 or more oblige to be registered under the GST. Level 4 Lot 6 Jalan 51217 46050 Petaling Jaya Selangor Malaysia.

The Malaysian VATSST system is largely modeled on the UK VATPrimarily the VATSST is a consumption tax on goods and services. Malaysias GST is zero-rated starting from 1 June 2018. Clubs Associations Societies Government Agencies Others.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. The VAT system is projected to make sure that the VAT price is ultimately paid by the final consumer and that it is not an additional. GST registration requirements are imposed on people who make taxable supplies for business purposes with a taxable turnover exceeding RM500000.

For non-profits this threshold increases to 150000 per year. Export goods and services are called zero-rated supplies and GST is not applicable. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

Submit your companys income tax return to LHDN within 7 months from the financial year end. Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident. In determining this threshold income arising from the supply of capital assets of the business which was previously excluded will now fall within the RM500000 threshold unless the capital assets are supplied or transferred as a result of the cessation of.

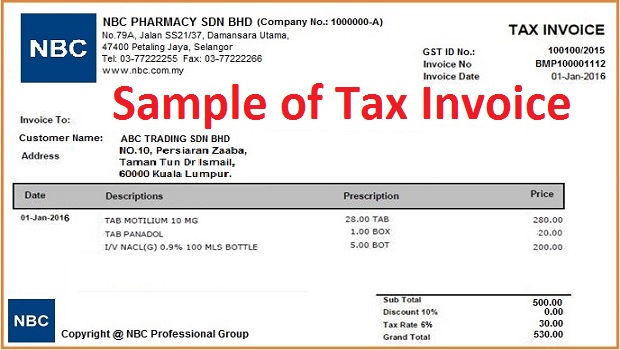

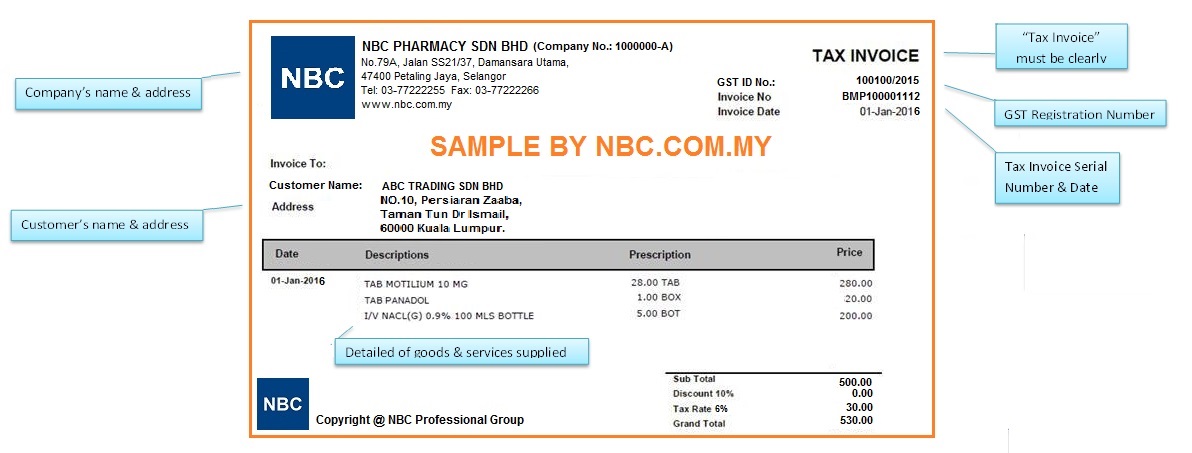

Most organizations use full invoices. GST registered companies should also ensure that the pricing of goods and services is at all. Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015.

From the suppliers perspective he will be entitled to a relief for bad debt if payment is not received within the same six month period and subject to meeting the. GST invoice format Select either Full invoice or Simplified invoice as the printing format for GST invoices. A registered person is required to charge output tax on.

Use self-billed invoice Set this option to Yes if you must issue self-billed invoices in some circumstances. Submission of GST returns for the respective taxable periods and claiming of input tax credit. However in some case the Director General can upon written request allow.

Every registered business will have to file their sales and service tax return at the government portal. However once registered the businesses must. Collecting GST in Malaysia.

RMCD is ready to accept application for registration from 1 June 2014. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. The threshold starting from 1 June 2013 and the business is liable to be registered for GST within twenty eight days from this date ie.

If a Malaysia company is not GST registered can it collect GST tax. GST Registration Number GST Reg No Description. The main concept of VAT in Malaysia is that only the value added to goods or services is going to be taxed.

Businesses with taxable turnover less than RM500. Here is what companies should know about the change in the tax environment of the country. GST invoices in Malaysia.

Must a Malaysia company collect GST when exporting goods or services out of Malaysia. If you are not anyone of the above you are required to register with Royal Malaysia Customs RMC and charge 6 GST to all your customers. Zero-Rated Supply Company If you are running business in Zero-Rated Supply category you do not need to charge 6 GST even though your companys yearly sales exceeds RM500000.

You must register for GST when your business exceeds an annual GST turnover rate of 75000 per year. It applies to most goods and services. Click Lookup GST Status.

603-7785 2624 603-7785 2625. Your business VAT number. As announced by the Government GST will be implemented on 1 April 2015.

In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. In the event that registration is not completed or required such businesses cannot charge and collect. Return Filing in Malaysia.

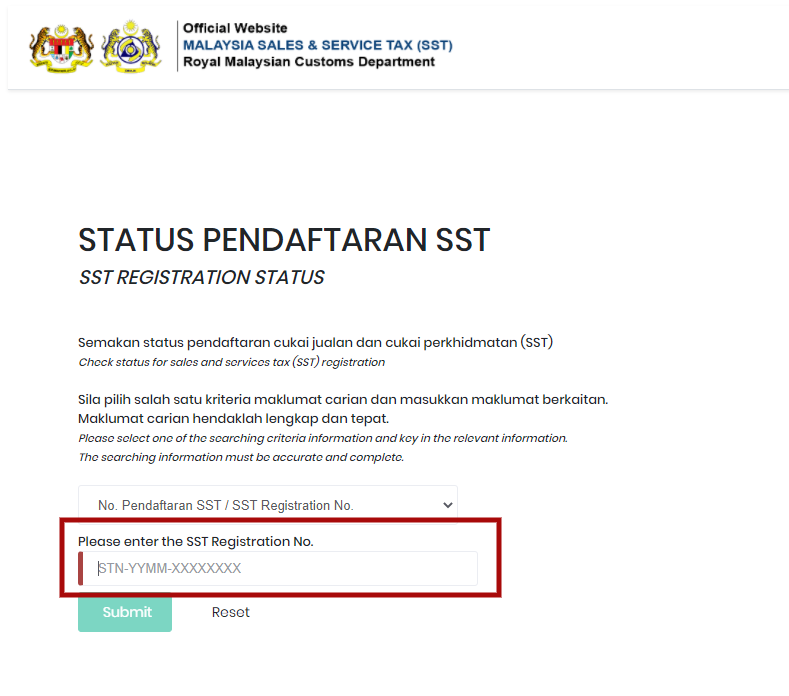

Their data will be transferred to create the SST Malaysia registration. If your business or enterprise has a GST turnover of 75000 or more gross income from all businesses minus GST see Calculating your GST turnover. The SST Malaysia registration or application process is carried out online via MySST system.

If your business annual sales do not exceed this amount you are not required to register for GST. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. Click Export header hyperlink to transfer the record to excel.

The two reduced SST rates are 6 and 5. Every company must register with Inland Revenue Board or more commonly known as Lembaga Hasil Dalam Negeri LHDN once the company has commenced its business activities. Related information can be found and downloaded from these.

Filing your income tax return with Inland Revenue Board. The Malaysia GST requires a GST-registered business which has made an input tax claim but fails to pay his supplier within six months from the date of supply to repay the input tax. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

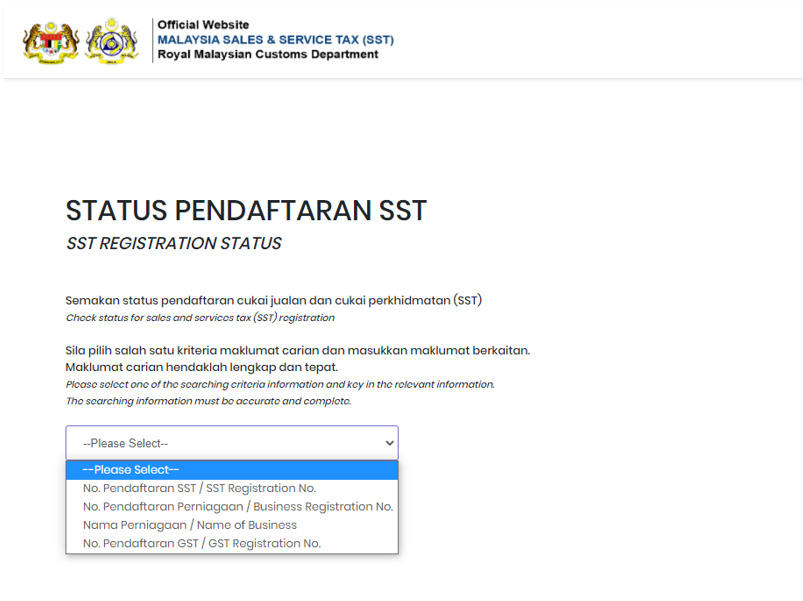

The application made through this system is auto-approved for. Your business name and address. List of search results will be.

Select any search Fill in related information. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration.

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Malaysia Gst Guide For Businesses

An Introduction To Malaysian Gst Asean Business News

Introduction Of Goods And Services Tax Gst In Malaysia Henry Goh Malaysia Brunei Patent Trade Mark And Industrial Design Agents

Malaysia Sst Sales And Service Tax A Complete Guide

Everything About Gst Registration Of A Private Limited Company Ebizfiling

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Step By Step Guide To Apply For Gst Registration

7 Days Business Gst Registration Services Pan Card Rs 10000 Id 23135425033

Gst Rates In Malaysia Explained Wise

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Malaysia Sst Sales And Service Tax A Complete Guide

Singapore Gst Registration Guide For Foreign Businesses Singaporelegaladvice Com

Step By Step Guide To Apply For Gst Registration

Do I Need To Register For Gst Goods And Services Tax In Malaysia

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Malaysia Sst Sales And Service Tax A Complete Guide

How To Check Sst Registration Status For A Business In Malaysia